Gratuity Funding Overview

Intro

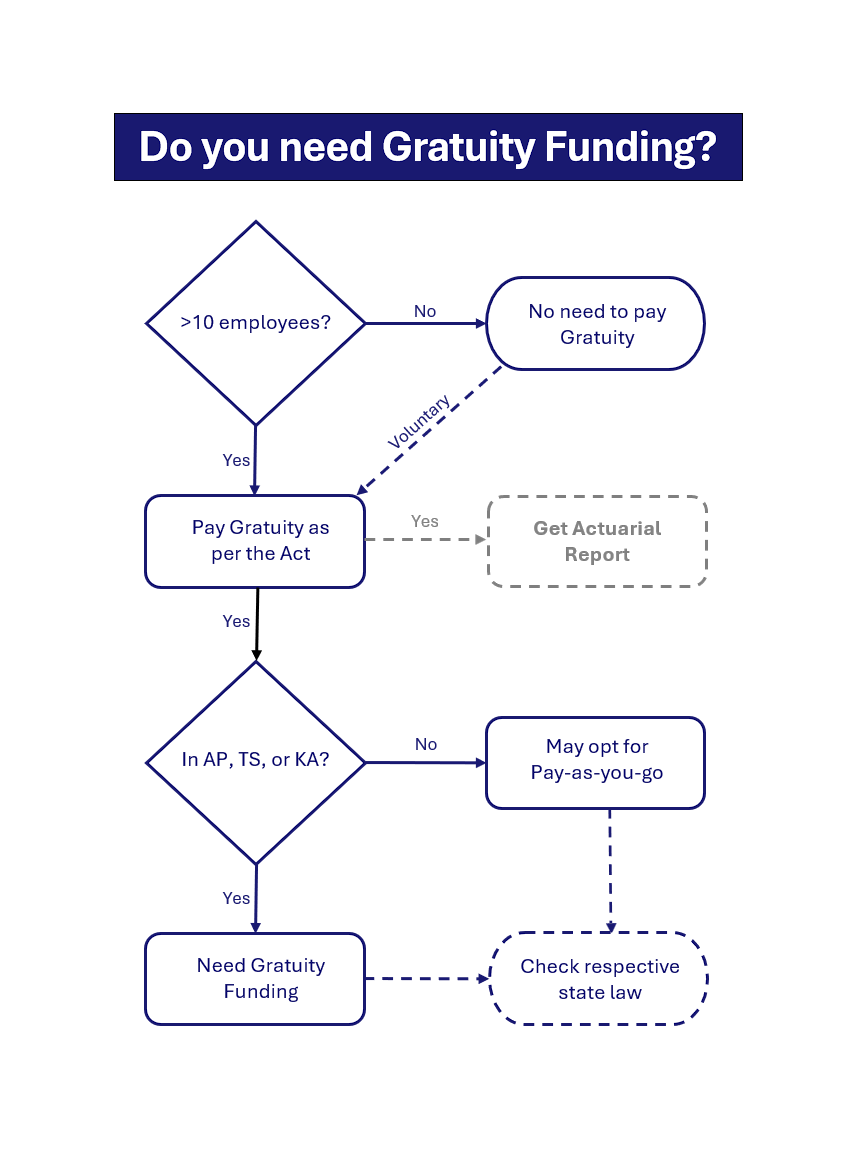

Gratuity Funding is an important aspect to consider for employers in India with 10+ employees. The reason being if you have (or ever had) 10 or more employees, then you need to pay Gratuity to your employees and comply with Payment of Gratuity Act, 1972, (Gratuity Act), and the Act has a special focus on gratuity funding.

Gratuity Liability

While the applicability of the Act is straightforward, there could be some confusion regarding provisioning of Gratuity Liability.

- Simply said, if you pay Gratuity to your employees, then you should book a Provisional Liability for expected Gratuity payments as per the applicable Accounting Standards.

- This is referred to as Gratuity “Defined Benefit Obligation” (DBO or DBO Liability or simply Gratuity Liability)

- As per both IndAS 19 and AS 15 Accounting Standards, the gratuity liability is calculated by an Actuary. You may refer to our blog on Actuarial Valuation of Gratuity report for further information.

Asset (Funded Gratuity scheme)

We have now created the liability in our books, but what about the Asset?

- As per the Gratuity Act (once the respective applicable government notifies), every Employer needs to obtain insurance for its Gratuity DBO Liability, from the LIC of India (or any other prescribed Insurer).

- Till now, only the State Government of Andhra Pradesh, Telangana, and Karnataka have notified the Compulsory Gratuity Insurance rules, with Karnataka being the latest addition to the list.

- For employers in other states, you may opt for Insurer-backed funds (asset). However, it is not mandatory unless notified as such.

- For more information on the Compulsory Gratuity Insurance rules, please consult with a legal expert.

Pay-as-you-go vs. Gratuity Fund

Pay-as-you-go:

Thus, based on location, companies may choose to keep their Gratuity scheme on Pay-as-you-go basis (simply referred to as “unfunded”). Under this arrangement, the employer meets Gratuity payouts from their operational cash flow if/when the Gratuity payment becomes due (upon exit of the employee).

Funded:

Or alternatively, they may “fund” their scheme. When a company takes a Gratuity Insurance from the LIC of India (or any other prescribed Insurer), it is said to have a Funded Gratuity Scheme. Employers also have the option to maintain a Trust Fund. However, in this blog, we have focused exclusively on insurer-backed Gratuity Funds.

Advantages of Gratuity Funding

Gratuity Funding refers to the process of setting aside sufficient funds to pay Gratuity to eligible employees at the time of retirement, resignation, or otherwise. We recommend maintaining a well-funded Gratuity scheme with a reputed insurer. Advantages are:

Risk Management

- Gratuity Liabilities can be significant, especially for larger/older organizations. And sometimes it may strain the financial position.

- There are various funds in the market, but the most effective ones allow companies to transfer entire liability to an insurance company, thus reducing insolvency risk.

Cashflow Management

- Premiums are known in advance and paid regularly.

- This helps in effective cashflow management, making them more predictable and avoiding surprises.

- This is especially helpful during unforeseen events such as mass layoffs, etc.

Financial Benefits

- The insurance company holds the funds and invests them to generate returns to cover future Gratuity payments.

- The premium paid towards the Gratuity Insurance is tax-deductible expense under the Income Tax Act.

Employee Assurance

- Insurer-backed fund ensures that the Gratuity is paid to employees on time. This gives assurance to the employees.

- Also, it could help with long-term retention strategy, especially for MSME Gratuity Schemes where employees may not have P&L and Balance sheet strength visibility.

M&A

- From our experience, it also results in smoother M&A processes, allowing parties to focus on core business valuations.

Conclusion

Gratuity Funding is a crucial aspect of employee welfare and financial planning. By implementing a sound strategy and using tools like Gratuity Insurance and regular Gratuity Valuations by an Actuary, employers can ensure they meet their legal obligations while maintaining financial stability.

Whether you’re an HR professional looking to optimize benefits for your team, an auditor ensuring compliance, or an employer planning for the future, proper Gratuity Funding is an investment in both your employees and your organization’s long-term health.